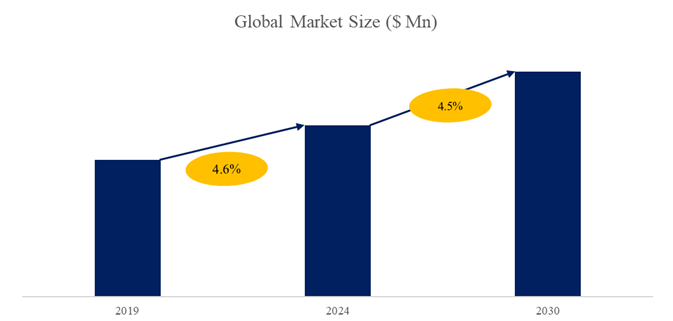

According to the new market research report “Global Industrial Electric Heating Element Market Report 2024-2030”, published by QYResearch, the global Industrial Electric Heating Element market size is projected to reach USD 4.43 billion by 2030, at a CAGR of 4.5% during the forecast period.

Figure. Global Industrial Electric Heating Element Market Size (US$ Million), 2019-2030

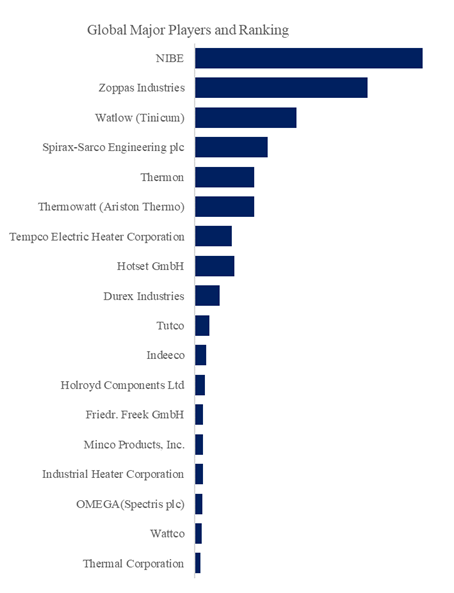

Figure. Global Industrial Electric Heating Element Top 10 Players Ranking and Market Share (Ranking is based on the revenue of 2023, continually updated)

According to QYResearch Top Players Research Center, the global key manufacturers of Industrial Electric Heating Element include NIBE, Zoppas Industries, Watlow (Tinicum), Spirax-Sarco Engineering plc, Thermon, Thermowatt (Ariston Thermo), Tempco Electric Heater Corporation, Hotset GmbH, Durex Industries, Tutco, etc. In 2023, the global top 10 players had a share approximately 28.0% in terms of revenue.

Market Drivers:

Industrialization and Manufacturing Growth: As industrialization continues to expand globally, there's a rising demand for electric heating elements in various manufacturing processes. Industries such as automotive, aerospace, food and beverage, chemical, and electronics rely on electric heating elements for applications like heating liquids, gases, solids, and surfaces.

Energy Efficiency and Sustainability: With increasing focus on energy efficiency and sustainability, industrial processes are shifting towards electric heating elements due to their ability to deliver precise and controllable heat with minimal waste. Electric heating elements offer advantages such as rapid heating, uniform temperature distribution, and low emissions compared to traditional heating methods, driving their adoption across industries.

Technological Advancements: Ongoing advancements in electric heating element technology, including the development of new materials, designs, and manufacturing techniques, are enhancing their performance, efficiency, and durability. Innovations such as advanced insulation materials, corrosion-resistant coatings, and IoT-enabled heating systems are expanding the capabilities and applications of electric heating elements.

Stringent Regulations and Standards: Increasing regulations pertaining to workplace safety, product quality, and environmental protection are driving the adoption of electric heating elements that comply with industry standards and certifications. Manufacturers are investing in high-quality, reliable heating solutions to meet regulatory requirements and ensure operational safety and efficiency.

Automation and Industry 4.0: The integration of automation and digitalization technologies in industrial processes, often referred to as Industry 4.0, is driving demand for smart heating solutions. Electric heating elements equipped with sensors, controls, and connectivity capabilities enable real-time monitoring, remote operation, and predictive maintenance, optimizing energy usage and enhancing process control and productivity.

Growing Demand for Customization: Industries are increasingly seeking customized heating solutions tailored to their specific requirements and applications. Manufacturers offering flexible design options, rapid prototyping, and customization services are well-positioned to capitalize on this trend and address diverse customer needs across different sectors.

Restraint:

Competing Heating Technologies: Electric heating elements face competition from alternative heating technologies such as gas-fired heaters, steam boilers, and infrared heating systems. Depending on the application, these alternative technologies may offer advantages such as lower operating costs, faster heating rates, or better heat transfer efficiency, posing a challenge to the widespread adoption of electric heating elements.

Initial Cost and Installation Complexity: While electric heating elements offer benefits such as precise temperature control and uniform heating, their initial installation costs can be higher compared to some alternative heating technologies. Additionally, the complexity of installing electric heating systems, especially in retrofit applications or facilities with limited electrical infrastructure, may deter some customers from choosing electric heating solutions.

Energy Costs and Efficiency Concerns: Electric heating elements are subject to fluctuations in electricity prices, which can impact operating costs for end-users. In regions where electricity costs are high or supply reliability is a concern, industrial consumers may opt for alternative heating technologies with lower energy consumption or fuel costs. Additionally, concerns about the overall energy efficiency of electric heating systems, particularly in large-scale industrial applications, may influence purchasing decisions.

Application Limitations: Certain industrial processes or applications may not be well-suited for electric heating elements due to factors such as space constraints, temperature requirements, or material compatibility. For example, in high-temperature applications or processes involving corrosive materials, alternative heating methods may be preferred over electric heating elements.

Maintenance and Durability: Electric heating elements require regular maintenance to ensure optimal performance and longevity. Issues such as corrosion, scale buildup, or electrical failures can occur over time, leading to downtime and repair costs for end-users. In comparison, some alternative heating technologies may have simpler maintenance requirements or longer service intervals, reducing operational disruptions and maintenance expenses.

Opportunity:

Energy Efficiency Upgrades: With increasing emphasis on energy efficiency and sustainability, industries are seeking ways to reduce energy consumption and carbon emissions. Electric heating elements offer an energy-efficient solution compared to traditional heating methods, such as fossil fuel combustion or steam heating. There's a growing opportunity for manufacturers to capitalize on this trend by offering high-efficiency electric heating elements that help industrial facilities meet their sustainability goals while reducing operating costs.

Industry 4.0 Integration: The integration of digital technologies and automation in industrial processes, known as Industry 4.0, presents opportunities for smart electric heating solutions. By incorporating sensors, IoT connectivity, and advanced control systems, electric heating elements can provide real-time monitoring, predictive maintenance, and remote control capabilities. Manufacturers can leverage Industry 4.0 trends to develop innovative heating solutions that optimize energy usage, enhance process control, and improve productivity for industrial customers.

Customization and Specialization: Industries have diverse heating requirements depending on their specific processes and applications. There's a growing demand for customized electric heating solutions tailored to meet these unique needs. Manufacturers that specialize in designing and manufacturing custom heating elements for specific industrial applications, such as plastics processing, food production, or chemical processing, can capitalize on this opportunity to differentiate themselves in the market and provide added value to customers.

Expansion into Emerging Markets: Emerging markets, particularly in Asia-Pacific, Latin America, and Africa, offer significant growth opportunities for the industrial electric heating element market. Rapid industrialization, infrastructure development, and increasing manufacturing activities in these regions drive the demand for heating solutions across various industries. Manufacturers can expand their presence in these markets by offering reliable and cost-effective electric heating elements tailored to local needs and preferences.

Replacement and Retrofitting: Many industrial facilities rely on aging or inefficient heating systems that require upgrades or replacement. Electric heating elements offer a viable solution for retrofitting existing equipment or replacing outdated heating systems with modern, energy-efficient alternatives. There's an opportunity for manufacturers to target industries undergoing equipment modernization or seeking to improve energy efficiency by offering innovative electric heating solutions that meet their specific requirements.

For more information, please contact the following e-mail address:

Email: global@qyresearch.com

Website: https://www.qyresearch.com

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing nonlinear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF frontend, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.