Robotic Integration and Automation Solutions Market Summary

Robotic integration and automation solutions refer to the integration of robotic systems into industrial processes to automate tasks, improve efficiency, and enhance overall productivity. These solutions involve the use of robotics, sensors, software, and other technologies to create a seamless and integrated workflow. The goal is to streamline operations, reduce manual labor, and achieve higher levels of precision and consistency in manufacturing and other industries.

Integration is the process of programming and outfitting industrial robots so they can perform automated manufacturing tasks. Robot integrators are companies that will analyse your robotic system needs, provide a plan for automation, and put the automation into production.

Robot system integration is based on large-scale projects and factory production lines, and provides services such as system design and equipment integration in industrial control, transmission, communication, production and management based on the robot body. The core hardware and software are the robot body, robot end-effectors and fixtures, advanced manufacturing process equipment, various sensors (including tactile, force, vision, etc.), on-site industrial control software and information interaction, etc.

Figure. Robotic Integration and Automation Solutions Product Picture

Source: Secondary Sources and QYResearch, 2024

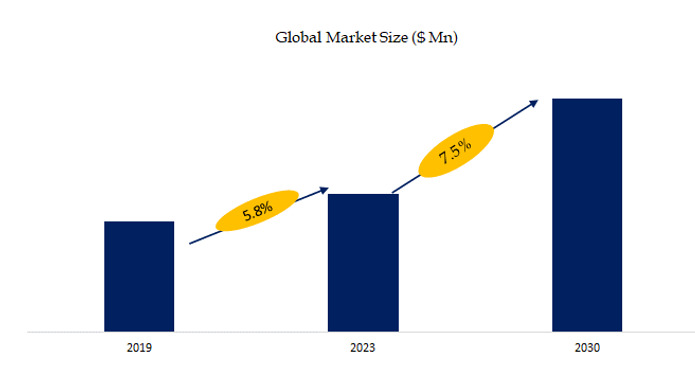

According to the new market research report “Global Robotic Integration and Automation Solutions Market Report 2023-2030”, published by QYResearch, the global Robotic Integration and Automation Solutions market size is projected to reach USD 77.63 billion by 2030, at a CAGR of 7.5% during the forecast period.

Figure. Global Robotic Integration and Automation Solutions Market Size (US$ Million), 2019-2030

Above data is based on report from QYResearch: Global Robotic Integration and Automation Solutions Market Report 2023-2030 (published in 2024). If you need the latest data, plaese contact QYResearch.

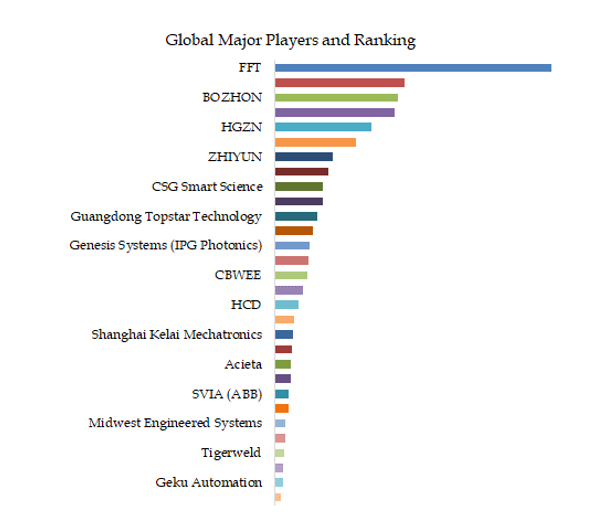

Figure. Global Robotic Integration and Automation Solutions Top 29 Players Ranking and Market Share (Ranking is based on the revenue of 2023, continually updated)

Above data is based on report from QYResearch: Global Robotic Integration and Automation Solutions Market Report 2023-2030 (published in 2024). If you need the latest data, plaese contact QYResearch.

According to QYResearch Top Players Research Center, the global key manufacturers of Robotic Integration and Automation Solutions include FFT, Motoman Robotics, BOZHON, STEP, HGZN, Colibri Technologies, ZHIYUN, EFFORT, CSG Smart Science, Guangzhou Risong Technology, etc. In 2023, the global top 10 players had a share approximately 5.0% in terms of revenue.

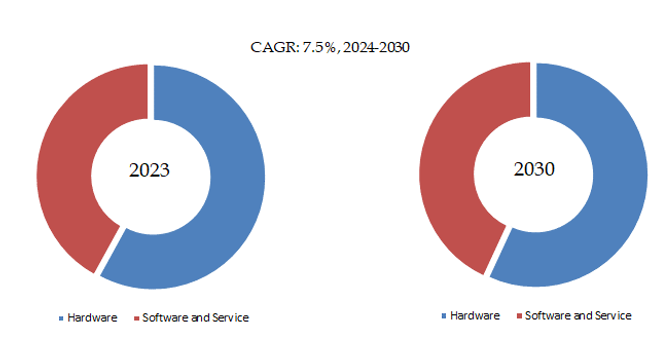

Figure. Robotic Integration and Automation Solutions, Global Market Size, Split by Product Segment

Based on or includes research from QYResearch: Global Robotic Integration and Automation Solutions Market Report 2023-2030.

In terms of product type, Hardware is the largest segment, hold a share of 58.0%,

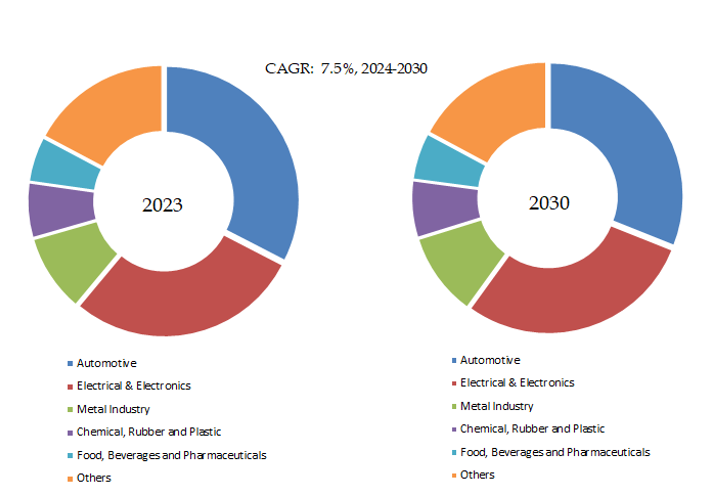

Figure. Robotic Integration and Automation Solutions, Global Market Size, Split by Application Segment

Based on or includes research from QYResearch: Global Robotic Integration and Automation Solutions Market Report 2023-2030.

In terms of product application, Automotive is the largest application, hold a share of 32.6%,

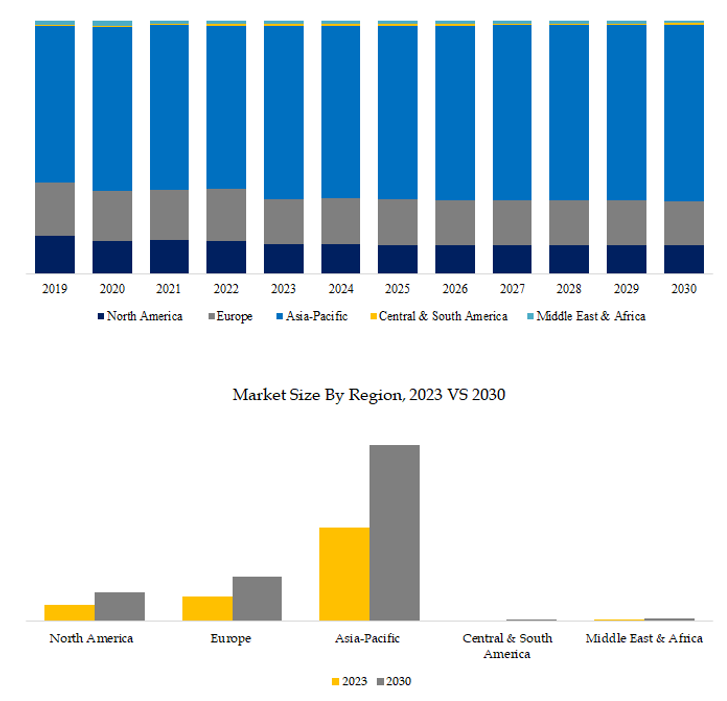

Figure. Robotic Integration and Automation Solutions, Global Market Size, Split by Region

Based on or includes research from QYResearch: Global Robotic Integration and Automation Solutions Market Report 2023-2030.

Market Drivers:

D1: Efficiency Improvement: One of the primary drivers is the pursuit of increased efficiency in industrial processes. Robotic integration and automation solutions enable tasks to be performed with precision, speed, and consistency, leading to overall process optimization and reduced production times.

D2: Technological Advancements: Continuous advancements in robotics, artificial intelligence, and sensor technologies drive innovation in automation solutions. Improved capabilities, increased functionality, and reduced costs of these technologies contribute to the growth of the market.

D3: Rising Demand in Industries: Industries such as automotive, electronics, healthcare, and logistics are witnessing increased demand for automation to meet production volumes, handle intricate tasks, and adapt to changing market requirements.

Restraint:

R1: Complexity of Implementation: Integrating robotic systems into existing processes can be complex, requiring expertise in both automation technology and the specific industry. The need for specialized skills during the implementation phase can contribute to higher costs.

R2: Customization Requirements: Industries often have unique processes and requirements. Customizing robotic integration solutions to meet specific needs adds to the complexity and cost of implementation.

R3: Technology Upgrades: Rapid technological advancements may lead to the need for frequent upgrades to keep automation systems current and competitive. These upgrades can contribute to ongoing costs for businesses.

Challenges:

C1: Human-Robot Collaboration: Ensuring the safe interaction between humans and robots is crucial. Safety concerns, especially in environments where humans and robots work together, may slow down the adoption of automation solutions. Adhering to safety standards and implementing robust safety features is a priority.

C2: Downtime Impact: Regular maintenance is crucial for the optimal performance of robotic systems. However, scheduled maintenance can result in downtime, affecting overall production efficiency. Finding a balance between maintenance needs and continuous operation is a challenge.

C3: Supply Chain Challenges: The semiconductor and electronic components used in automation systems are subject to global supply chain disruptions. Shortages or delays in the availability of critical components can impact the deployment and maintenance of robotic integration solutions.

About the Authors

| Wei Qin |

|||

| Lead Author | |||

| Semiconductor and Electronics Email: qinwei@qyresearch.com |

|||

About QYResearch

QYResearch founded in California, USA in 2007. It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.