Class B AIS Transponders Market Summary

Class B AIS (Automatic Identification System) transponders are devices used in maritime communication and navigation to enhance the visibility and safety of vessels. AIS is an automated tracking system that allows ships to transmit and receive information about their identity, position, course, and speed to other nearby vessels, as well as to shore-based stations. Class B AIS transponders are typically used by smaller vessels that are not required to carry the more advanced Class A AIS transponders.

According to the new market research report “Global Class B AIS Transponders Market Report 2023-2030”, published by QYResearch, the global Class B AIS Transponders market size is projected to reach USD 0.03 billion by 2030, at a CAGR of 6.5% during the forecast period.

Figure. Global Class B AIS Transponders Market Size (US$ Million), 2019-2030

Above data is based on report from QYResearch: Global Class B AIS Transponders Market Report 2023-2030 (published in 2024). If you need the latest data, plaese contact QYResearch.

Figure. Global Class B AIS Transponders Top 12 Players Ranking and Market Share (Ranking is based on the revenue of 2023, continually updated)

Above data is based on report from QYResearch: Global Class B AIS Transponders Market Report 2023-2030 (published in 2024). If you need the latest data, plaese contact QYResearch.

According to QYResearch Top Players Research Center, the global key manufacturers of Class B AIS Transponders include SRT Marine, Alltek Marine, Furuno, Navico, Garmin, Icom, Vesper Marine, Comnav Marine, True Heading, Transas Marine Limited (Wärtsilä), etc. In 2023, the global top five players had a share approximately 69.0% in terms of revenue.

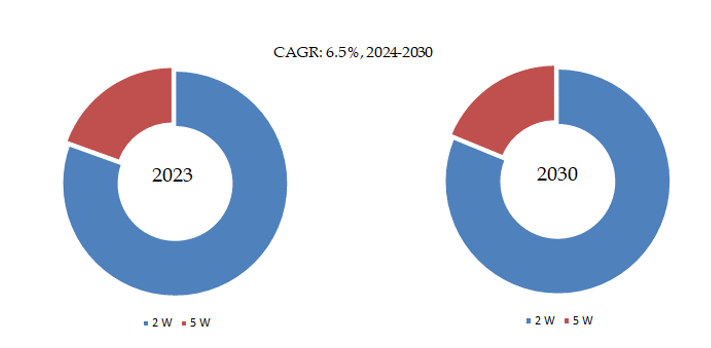

Figure. Class B AIS Transponders, Global Market Size, Split by Product Segment

Based on or includes research from QYResearch: Global Class B AIS Transponders Market Report 2023-2030.

In terms of product type, 2 W is the largest segment, hold a share of 80.5%,

Figure. Class B AIS Transponders, Global Market Size, Split by Application Segment

Based on or includes research from QYResearch: Global Class B AIS Transponders Market Report 2023-2030.

In terms of product application, Recreational Vessels is the largest application, hold a share of 46.2%,

Figure. Class B AIS Transponders, Global Market Size, Split by Region

Based on or includes research from QYResearch: Global Class B AIS Transponders Market Report 2023-2030.

Market Drivers:

D1: Maritime Safety Regulations: Compliance with international maritime safety regulations is a significant driver. Many maritime authorities worldwide require certain vessels, particularly those under a certain size, to be equipped with Class B AIS transponders to enhance safety and navigation.

D2: Cost-Effective Solution for Smaller Vessels: Class B AIS provides a cost-effective solution for smaller vessels that are not mandated to carry Class A AIS transponders. This affordability factor contributes to the widespread adoption of Class B AIS among a diverse range of maritime users.

D3: Rise in Recreational Boating: The recreational boating sector has seen increased adoption of Class B AIS transponders. Boaters and yacht owners recognize the safety benefits of having AIS onboard, especially when navigating in areas with commercial traffic.

Restraint:

R1: Class B AIS transponders might face challenges if the cost of these devices remains relatively high. In certain markets or segments, cost considerations could restrain the widespread adoption of Class B AIS technology, especially among smaller vessels or operators with limited budgets.

R2: Intense competition within the AIS transponder market, including both Class A and Class B devices, could result in price wars and thinner profit margins. This competitive environment may impact the growth prospects for companies operating in the Class B AIS transponders segment.

Challenges:

C1: Class B AIS transponders typically have a shorter transmission range and lower reporting rate compared to Class A transponders. This limitation may be a challenge in areas with congested maritime traffic or for vessels operating in remote regions where a broader coverage is necessary.

C2: Interference from other electronic devices or radio signals can affect the performance of Class B AIS transponders. Signal degradation may impact the accuracy and reliability of the information transmitted, posing a challenge in maintaining effective communication.

C3: Meeting and adapting to evolving maritime regulations can be challenging for manufacturers and users of Class B AIS transponders. Changes in regulatory requirements may necessitate updates or modifications to the devices, adding complexity to compliance efforts.

About the Authors

| Wei Qin |

|||

| Lead Author | |||

| Semiconductor and Electronics Email: qinwei@qyresearch.com |

|||

About QYResearch

QYResearch founded in California, USA in 2007. It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.